Estate Planning Attorney Fundamentals Explained

Estate Planning Attorney Fundamentals Explained

Blog Article

The Buzz on Estate Planning Attorney

Table of ContentsThe Buzz on Estate Planning AttorneySome Ideas on Estate Planning Attorney You Should KnowEstate Planning Attorney Things To Know Before You BuyThe Best Guide To Estate Planning Attorney

Your lawyer will also assist you make your records authorities, scheduling witnesses and notary public signatures as required, so you do not need to bother with trying to do that final step on your own - Estate Planning Attorney. Last, but not least, there is valuable peace of mind in establishing a connection with an estate planning attorney that can be there for you down the roadSimply placed, estate preparation attorneys offer value in many means, much beyond merely offering you with printed wills, trusts, or various other estate intending papers. If you have concerns regarding the process and desire to find out much more, contact our workplace today.

An estate preparation attorney aids you define end-of-life decisions and lawful papers. They can set up wills, develop trust funds, create healthcare regulations, establish power of lawyer, create sequence plans, and more, according to your desires. Collaborating with an estate preparation attorney to complete and supervise this legal documentation can help you in the adhering to eight locations: Estate preparing attorneys are professionals in your state's count on, probate, and tax obligation legislations.

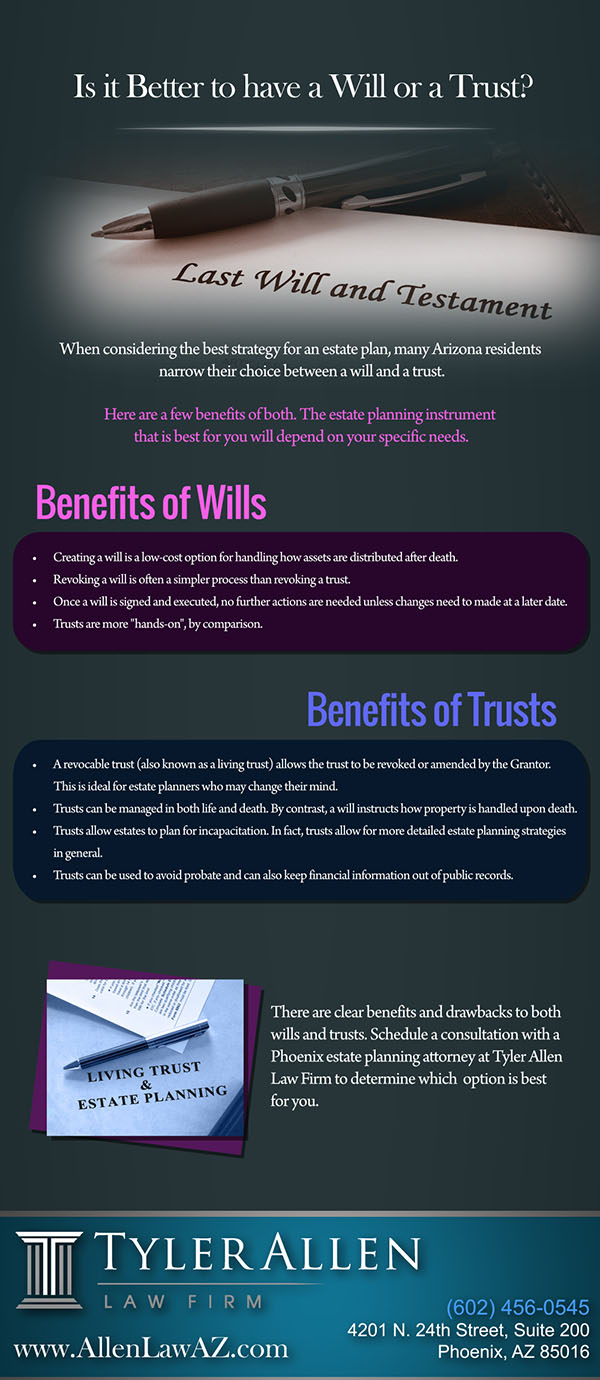

If you don't have a will, the state can decide just how to split your properties among your beneficiaries, which could not be according to your dreams. An estate planning attorney can aid organize all your legal papers and distribute your possessions as you want, possibly avoiding probate.

Not known Factual Statements About Estate Planning Attorney

Once a client dies, an estate strategy would certainly determine the dispersal of properties per the deceased's instructions. Estate Planning Attorney. Without an estate strategy, these decisions might be delegated the following of kin or the state. Tasks of estate organizers include: Creating a last will and testimony Establishing count on accounts Naming an executor and power of attorneys Recognizing all recipients Calling a guardian for minor children Paying all financial obligations and reducing all tax obligations and legal fees Crafting guidelines for passing your worths Developing preferences for funeral arrangements Finalizing guidelines for treatment if you come to be sick and are not able to choose Obtaining life insurance policy, disability revenue insurance coverage, and long-lasting care insurance coverage A great estate plan should be upgraded regularly as customers' financial scenarios, personal inspirations, and government and state legislations all evolve

Just like any occupation, there are features and abilities that can assist you achieve these goals as you deal with your customers in an estate organizer function. An estate planning job can be best for you if you possess the following characteristics: Being an estate coordinator suggests believing in the long-term.

Getting The Estate Planning Attorney To Work

You need to aid your customer expect his/her end of life and what will certainly occur postmortem, while at the exact same time not house on dark ideas or emotions. Some clients may become bitter or distraught when contemplating death and it could be up to you to aid them via it.

In the occasion of fatality, you might be expected image source to have various conversations and transactions with making it through relative regarding the estate plan. In order to excel as an estate planner, you might need to stroll a great line of being a shoulder to lean on and the private relied on to communicate estate preparation matters in a prompt and professional manner.

Anticipate that it has been modified further considering that then. Depending on your client's monetary income bracket, which might advance toward end-of-life, you as an estate coordinator will certainly have to maintain your client's possessions in complete lawful compliance with any local, government, or global tax laws.

The 7-Minute Rule for Estate Planning Attorney

Gaining this certification from organizations like the National Institute of Qualified Estate Planners, Inc. can be a solid differentiator. Being a member of these professional groups can validate your skills, making you more appealing in the eyes of a possible customer. In addition to the emotional reward of helping customers with end-of-life preparation, estate coordinators take pleasure in the advantages of a steady income.

Estate planning is a smart thing to do regardless of your current wellness and monetary condition. Not so several individuals recognize where to begin the procedure. The very first important point is to employ an estate planning lawyer to help you with it. The following are 5 benefits of functioning with an estate planning attorney.

The portion of people that don't know just how to get a will has actually enhanced from 4% to 7.6% since 2017. A seasoned attorney recognizes what info to include in the will, including your recipients and special factors to consider. A will secures your family from loss since of immaturity or disqualification. It likewise gives the swiftest go to my blog and most efficient approach to transfer your possessions to your recipients.

Report this page